Science backed. Goal based.

Our Cutting Edge Investment Process.

Research shows that the majority of professional fund managers do not achieve investment returns above their relevant benchmark. Their performance actually becomes less and less reliable as time goes on.....

We structure our strategies based on academic research and the science of capital markets rather than on speculation and perceived skill like traditional fund managers. We firmly believe that prudent investing is a rational process which involves deciding how much risk to take, then choosing asset classes to match that risk-return trade-off.

Our preferred managers include numerous world class financial economists and academics like Kennith Fama who was recently awarded the nobel prize in economics for his work on the development of the efficient market hypothesis.

We prefer managers that operate with the following core beliefs in mind:

-

Securities are fairly priced over time in liquid and competitive markets

-

Diversification across major asset classes is essential

-

Investing involves trading off risks and costs with expected returns.

The scientifically proven factors of return that we specifically target to achieve these results are:

-

Size - Small company stocks have higher expected returns over time than large company stocks.

-

Price and Book to Market - Low priced value stocks have higher expected returns than higher priced growth stocks (hot stocks). Warren Buffet is one of the most famous proponents of this strategy.

-

Profitability - Companies with higher profitability ratios, when measured using earnings to asset and earnings to book values over time, tend to outperform those with lower profitability ratios.

-

Momentum - Companies that have performed well during the last month tend to outperform those that have performed poorly in the short term. This factor can be used to implement cost-effective trading and avoid "value traps" which can occur when a trading signal is triggered and the manager is forced to sell or buy specific holdings at an inopportune time.

-

Cost - Investment and implementation costs must be kept as low as possible throughout the investment process. Our preferred managers have some of the lowest cost ratios available.

Index Investing and the Core-satellite Approach.

An index is a group of securities designed to represent a broad market or a portion of the broad market. An example of a broad market may be the ASX 200. An indexing approach will ensure portfolio performance is broadly in line with the returns of the underlying asset class or market over the long-term. The index for each broad market sector is utilised by the investment world to measure their performance against and hence can be referred to as the benchmark.

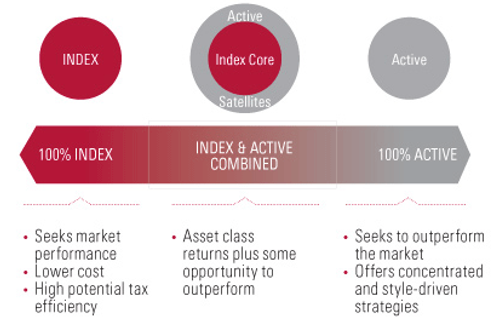

We invest in the benchmark and then add our preferred managers to provide the highest probability of outperformance over time. By investing in the benchmark and surrounding it with proven investment managers we utilise what is known as a "core-satellite" approach to portfolio management.

The following graphic illustrates the range of possible strategies from pure index investing through to pure active management. We sit in between these two camps.

We teach our clients that risk and return are inherently linked over the long term. Any deviation from the market portfolio must, by definition, experience periods of out-performance and under-performance. Our investors must decide if they are comfortable in deviating from a market-weight portfolio and consider the potential excess returns and excess risks in each situation.

We monitor our portfolios every day and continually search for ways to add more value to our clients circumstances.

Avoiding Big Mistakes.

One of our core purposes is to help our clients avoid big mistakes.

An individual who is investing for retirement in 30 years should not be too concerned with short term investment volatility (up and down movements) from one day to the next. What is important is that the investments continue to perform in line with expectations, which we track by constantly checking the performance against the most relevant benchmark. The biggest challenge over an investment time frame of 15 to 30 years however is staying the course.

The following graph illustrates how a $10,000 investment would have been affected by missing the S&P 500 market's top-performing days over the 20-year period from January 1, 1994, to December 31, 2013.

An individual who remained invested for the entire time period would have accumulated $58,350, while an investor who missed just 5 of the top-performing days during that period would have accumulated only $38,723.

The biggest risk to your investments is not volatility or losing money in bad times, it is being out of the market for the wrong times. Fortunately you can control that! With a trusted adviser by your side you will never make a decision based purely on emotions like fear.